Starting Simulation

You can start a new simulation by choosing New Simulation button.

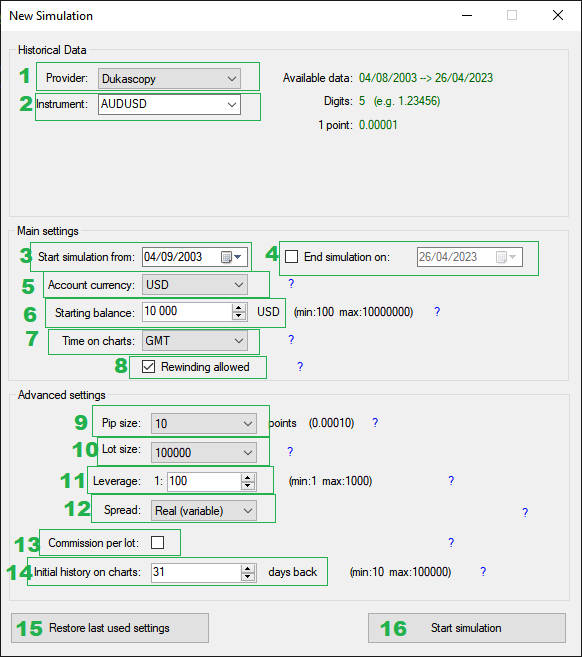

New Simulation window will appear. It lets you set up all basic and advanced settings before starting a new simulation.

Data Settings

1. Provider

Choose the source of data to use for this simulation:

- Dukascopy

- TrueFX

- HistData

- Metatrader (your MT4 broker)

2. Instrument

Choose the instrument to simulate. If you can't find the instrument on the list, it means that you need to download it in Data Center first.

Main Settings

3. Start simulation from

Choose the starting day of the simulation

4. End simulation on (Optional)

If you want, you can choose to end the simulation on selected day. If you do not select this option, the simulation will run until it reaches the end of data.

5. Account currency

Choose the currency that will be used throughout the simulation. It will be used to display balance/equity, profit/loss, drawdown and all other statistics.

6. Starting balance

Set the amount of money to start with.

7. Time on charts

Forex Simulator supports two time modes:

- GMT

Time used by the simulator will be GMT (UTC+0). Daylight Savings Time (DST) will not be taken into account. - New York Close

The simulator will shift historical data in such way that the end of day on the chart will be aligned with the end of New York trading session. This effectively means using GMT+2 or GMT+3 depending on winter/summer time in New York. It also means displaying only 5 daily bars in a week (no Sunday candle). Please note that it is not the same as setting the clock to New York time. More information about New York Close charts can be found on this page.

8. Rewinding allowed

Enable or disable moving backward during the simulation. Moving backward may be useful in many cases, but it also gives a possibility of cheating.

Advanced Settings

9. Pip size

Set the size of 1 pip. Default value should be good for currency pairs (read about pips in Forex), but you may want to adjust it for other instruments.

10. Lot size

Set the size of 1 lot. Standard lot size in Forex is 100,000 units of currency, but it may be different in case of other instruments.

11. Leverage

Set maximum leverage available when taking trades. Bigger leverage lets you take bigger trades with less money (smaller margin requirements). Leverage is the inverse of margin required for taking a trade.

12. Spread

Spread is the difference between Ask and Bid prices. You can choose which type of spread you would like to use:

- Real (variable, floating) - Use real spread supplied by data provider (Dukascopy, TrueFX, HistData).

- Fixed - Set your own fixed size of spread. It won't change throughout the simulation.

13. Commission per lot (Optional)

Some brokers charge commission for taking trades. You can simulate this and decide how much you want to be charged for every traded lot.

14. Initial history on charts

By default, the simulator will start with a 31-day lookback. It means that at the beginning of simulation charts will show only 31 days of history (of course, they will grow with time). You can change initial lookback with this setting.

Please remember that lookback may also be constrained by the amount of downloaded data before the starting day.

15. Restore last used settings

Bring back settings used in the last simulation. It will overwrite all settings in this window with last simulation's settings.

16. Start simulation

Click when you are ready to start.